Markets stayed calm after the U.S. intervention in Venezuela, exposing oil scarcity as political theater rather than a real supply shock.

In the early hours of January 3, 2026, the United States launched a large-scale military operation inside Venezuela. Operation Absolute Resolve involved extensive airstrikes across northern Venezuela and a special operations raid in Caracas that resulted in the capture and extrajudicial rendition of Venezuelan president Nicolás Maduro and his wife, Cilia Flores.

By the end of the day, Maduro was in U.S. custody, facing federal charges in New York. This was not simply a coup, nor merely an internal collapse. It was an overt intervention that could not be obscured, outsourced, or plausibly denied.

The operation represented the open use of U.S. military power against a sitting head of state, framed publicly as a law-enforcement action and justified through repeated, unusually blunt references to Venezuela’s oil resources. The language was not careful or coded. Oil was named plainly, insistently, and without apology.

By conventional logic, such an event should have shaken global markets. Venezuela holds the largest proven oil reserves in the world, and the forcible removal of a president by a foreign military, following months of blockades and tanker seizures, fits the textbook definition of geopolitical destabilization.

Yet when markets opened the following Monday, the reaction was strikingly calm. Oil prices rose modestly, while U.S. equity indices barely moved.

This absence of panic was not a misreading of events. It was the signal. Markets did not misunderstand what had occurred. They understood it precisely.

What the Market Actually Priced

The market response was notable not for its drama, but for its restraint. Crude prices briefly reacted to headlines before softening, with both Brent and WTI closing lower.

There was no sustained supply-shock pricing, no surge in volatility, no scramble for protection. Equity futures edged modestly higher, and there was no broad move into risk-off assets.

The movement that mattered was internal. Energy companies rose not because Venezuelan oil suddenly appeared profitable, but because the political veto surrounding Venezuelan resources was shown to be enforceable.

Defense contractors rallied because U.S. coercive capacity had just been exercised decisively without destabilizing the broader system. Venezuelan bonds climbed on the assessment that defiance had been punished without state collapse.

Gold rose alongside equities, not out of confusion, but as a hedge against the tail risks inherent in political enforcement.

This constellation of movements makes little sense if markets are read emotionally or morally. It makes perfect sense if they are read materially.

Why the Oil Story Fails Economically

If the intervention in Venezuela had genuinely created oil scarcity, markets would have responded very differently. They did not.

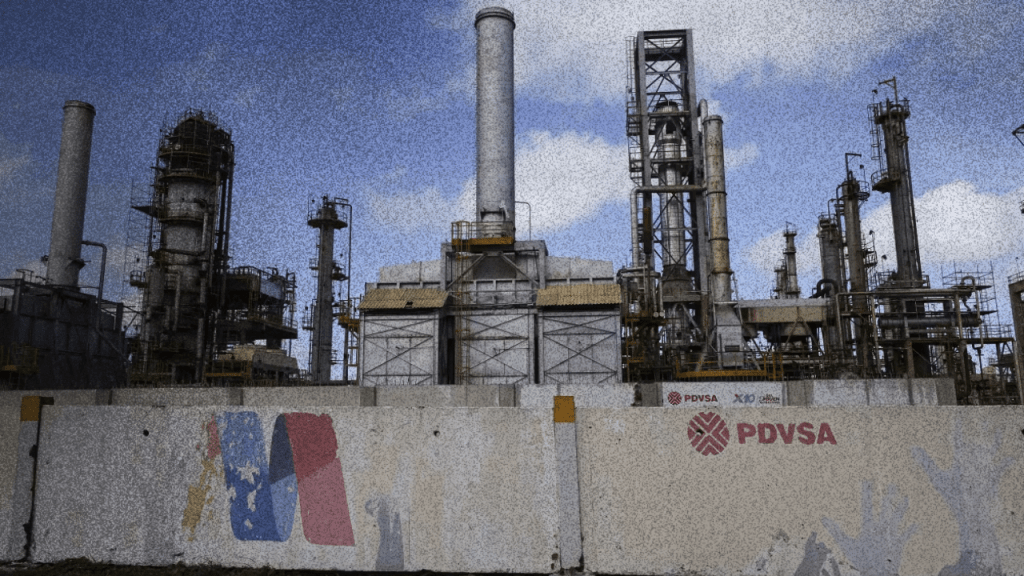

Venezuela’s crude is heavy, viscous, and expensive to extract, requiring specialized infrastructure and long investment horizons.

Years of sanctions, underinvestment, and labor flight have degraded the sector severely. Restoring production at scale would demand enormous upfront capital and a level of political stability that does not exist.

The global context further undermines the oil narrative.

Oil is not in a supercycle, and long-term demand growth is increasingly uncertain as electrification advances and energy transition accelerates, particularly in China.

Heavy crude, best suited for diesel, faces structural decline in major markets. For large energy firms, Venezuela represents layered risk rather than opportunity.

Markets understand this reality, which is why they did not price a surge of investment or a renaissance of Venezuelan production. Oil prices did not rise because no real scarcity was created. They fell.

That alone falsifies the literal “blood for oil” explanation.

Oil as Performance, Not Strategy

The persistence and bluntness of oil rhetoric, therefore, require a different explanation. Oil dominates the public narrative not because it drives the strategy, but because it provides a familiar language through which power can explain itself.

In the early 2000s, oil’s centrality had to be defended indirectly. Instability was manufactured, risk premiums were embedded, and scarcity was produced through chaos.

The narrative of Iraq took years to be laundered into incompetence and mistake. In Venezuela, that subtlety is gone.

Oil is invoked immediately and openly, even when the economics do not support it. This bluntness is not evidence of sincerity. It is evidence that the system no longer expects the story to be tested.

Oil functions as a signifier of hierarchy, a prop that renders coercion legible and emotionally satisfying to a domestic audience. It frames intervention as transactional rather than imperial, even when the transaction itself makes little economic sense.

Oil explains the story. It does not explain the operation.

False Scarcity Without Chaos

This marks a critical evolution from earlier interventions. Iraq created a false sense of scarcity by destabilizing the oil geography. Venezuela demonstrates false scarcity maintained without destabilization at all.

Infrastructure was left intact. Production was not meaningfully disrupted. The military remained functional. Succession was managed. The blockade remained in place. Nothing about the operation created real scarcity. And yet oil rhetoric intensified, sovereignty was disciplined, and compliance was reasserted.

This reveals a shift in how power operates. False scarcity no longer requires chaos. It only requires proof that access is conditional. That is a colder, more advanced version of the same logic.

What Was Actually Achieved

Operation Absolute Resolve did not aim to maximize production or attract immediate capital. It aimed to demonstrate something more fundamental: that refusal itself carries consequences.

Venezuela had long represented a contradiction, pairing enormous resources with political defiance. The intervention resolved that contradiction symbolically rather than economically. It clarified hierarchy without breaking markets.

From capital’s perspective, this was not instability but clarification. That is why oil prices fell rather than spiked. The crisis was not a shortage. It was an assertion.

What the Market Reaction Proves

Markets are brutally literal. They do not price speeches or nationalist theater. They price barrels, flows, and risk. If oil scarcity had been real, prices would have surged, volatility would have exploded, and risk assets would have fled.

Instead, markets behaved as though oil remains abundant, disruption was managed, and enforcement was surgical. Energy stocks rose modestly. Gold hedged enforcement risk. Bonds priced reduced defiance, but oil prices ultimately didn’t surge.

This was not scarcity pricing. It was hierarchy pricing.

The Venezuela Verdict

The Venezuela intervention confirms once again that oil scarcity is no longer geological or economic in nature. It is political and symbolic. Enforcement replaces disruption. Rhetoric replaces strategy.

If Iraq represented false scarcity through chaos, Venezuela represents false scarcity through demonstration. The market reaction does not merely support this reading. It proves it. If this had been about oil scarcity, markets would have panicked.

They did not. They nodded.